Building a diversified investment portfolio is a crucial step for anyone looking to secure their financial future. A well-structured portfolio not only maximizes potential returns but also minimizes risks associated with market volatility. In this guide, we will explore the essential strategies and principles behind creating a diversified investment portfolio that aligns with your financial goals and risk tolerance. Whether you are a seasoned investor or just starting, understanding the importance of diversification is key to achieving long-term success.

In the following sections, we will delve into various asset classes, including stocks, bonds, and alternative investments, and how they can work together to create a balanced portfolio. You will learn about the significance of asset allocation and how to assess your risk profile to make informed investment decisions. Additionally, we will provide practical tips on how to regularly review and rebalance your portfolio to adapt to changing market conditions and personal circumstances.

By the end of this article, you will have a comprehensive understanding of how to build a diversified investment portfolio that not only protects your assets but also positions you for growth. So, if you’re ready to take control of your financial future and make informed investment choices, keep reading to discover the strategies that can help you achieve your financial aspirations.

Understanding Diversification

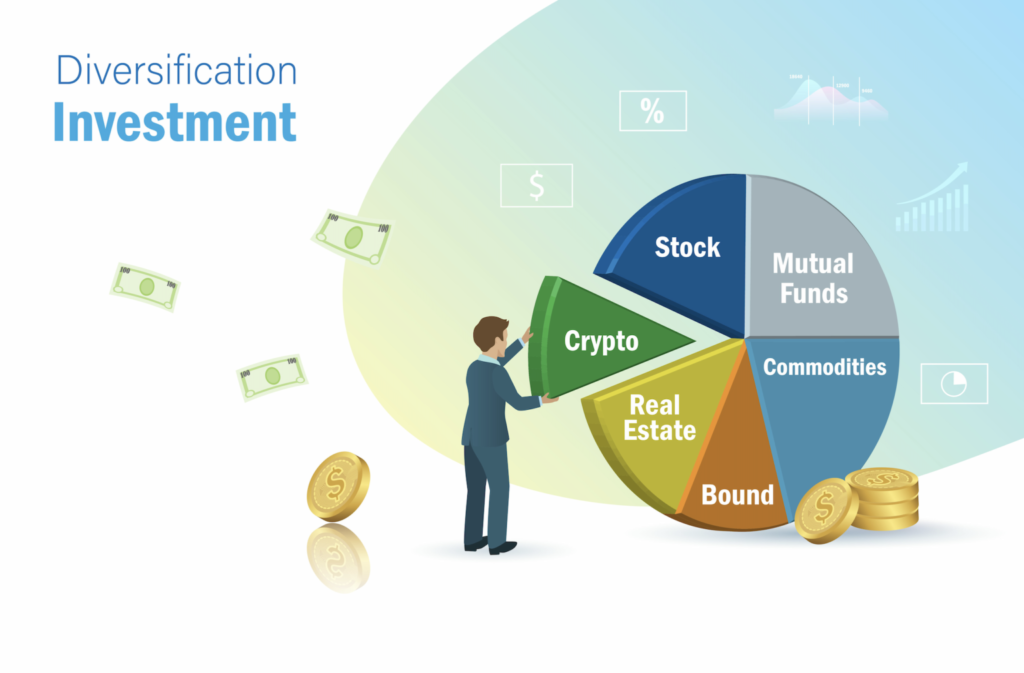

Diversification is a fundamental concept in investing that involves spreading your investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can mitigate the impact of poor performance in any single investment. This strategy is particularly important in volatile markets, where certain sectors may experience significant downturns while others thrive.

Investors often diversify their portfolios by including a mix of stocks, bonds, real estate, and other assets. This approach not only helps in managing risk but also enhances the potential for returns. Understanding the correlation between different asset classes is crucial, as it allows investors to create a balanced portfolio that can withstand market fluctuations.

Asset Allocation Strategies

Asset allocation is the process of deciding how to distribute your investments among different asset categories. A well-thought-out asset allocation strategy is essential for building a diversified investment portfolio. Common strategies include the 60/40 rule, where 60% of the portfolio is allocated to stocks and 40% to bonds, and more aggressive strategies that may involve higher percentages in equities.

Investors should consider their risk tolerance, investment goals, and time horizon when determining their asset allocation. Younger investors may opt for a more aggressive allocation, while those nearing retirement might prefer a conservative approach. Regularly reviewing and rebalancing your asset allocation is also important to ensure it aligns with your financial objectives.

Types of Investments to Consider

When building a diversified investment portfolio, it’s essential to consider various types of investments. Common options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Each type of investment has its own risk and return profile, making it important to understand how they fit into your overall strategy.

Stocks offer the potential for high returns but come with higher volatility. Bonds, on the other hand, are generally considered safer investments that provide steady income. Mutual funds and ETFs allow investors to gain exposure to a diversified basket of securities, making them an excellent choice for those looking to simplify their investment process.

The Role of Risk Tolerance

Risk tolerance is a critical factor in building a diversified investment portfolio. It refers to an investor’s ability and willingness to endure market fluctuations and potential losses. Understanding your risk tolerance helps in selecting the right mix of assets that align with your comfort level and financial goals.

Investors can assess their risk tolerance through questionnaires or by considering their investment experience, financial situation, and emotional response to market volatility. Those with a higher risk tolerance may choose to invest more heavily in stocks, while conservative investors might prefer bonds and other low-risk assets.

Importance of Regular Rebalancing

Regular rebalancing is essential for maintaining a diversified investment portfolio. Over time, certain investments may outperform others, leading to an unintentional shift in your asset allocation. Rebalancing involves adjusting your portfolio back to its original or desired allocation, ensuring that you remain aligned with your investment strategy.

Rebalancing can be done on a set schedule, such as annually or semi-annually, or triggered by significant market movements. This practice not only helps in managing risk but also enforces discipline in your investment approach, preventing emotional decision-making during market fluctuations.

Utilizing Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are popular choices for investors looking to build a diversified portfolio. These investment vehicles track specific market indices, providing broad market exposure with lower fees compared to actively managed funds. They are an excellent way to achieve diversification without the need for extensive research on individual stocks.

Investors can choose from various index funds and ETFs that focus on different sectors, regions, or asset classes. This flexibility allows for easy adjustments to your portfolio as market conditions change, making them a valuable tool for both novice and experienced investors.

Tax Considerations in Investment Diversification

Tax implications play a significant role in investment diversification. Different types of investments are subject to varying tax treatments, which can impact your overall returns. For instance, long-term capital gains are typically taxed at a lower rate than short-term gains, making it beneficial to hold investments for longer periods.

Investors should also consider tax-advantaged accounts, such as IRAs and 401(k)s, which can provide tax benefits while allowing for diversification. Understanding the tax implications of your investment choices is crucial for maximizing your returns and achieving your financial goals.

The Impact of Market Conditions on Diversification

Market conditions can significantly influence the effectiveness of diversification strategies. During periods of economic growth, a diversified portfolio may perform well as various asset classes appreciate. However, in times of market downturns, correlations between assets can increase, reducing the benefits of diversification.

Investors should stay informed about market trends and economic indicators to adjust their portfolios accordingly. Being proactive in managing your investments can help mitigate risks and capitalize on opportunities, ensuring that your diversified portfolio remains resilient in changing market conditions.

| Step | Description |

|---|---|

| 1. Define Your Investment Goals | Identify your financial objectives, such as retirement, buying a home, or funding education. This will guide your investment strategy. |

| 2. Assess Your Risk Tolerance | Evaluate how much risk you are willing to take. This will help determine the types of assets to include in your portfolio. |

| 3. Choose Asset Classes | Select a mix of asset classes such as stocks, bonds, real estate, and cash. Each class has different risk and return profiles. |

| 4. Diversify Within Asset Classes | Invest in a variety of sectors and industries within each asset class to reduce risk. For example, within stocks, consider technology, healthcare, and consumer goods. |

| 5. Consider Geographic Diversification | Invest in both domestic and international markets to spread risk across different economies and regions. |

| 6. Regularly Rebalance Your Portfolio | Periodically review and adjust your portfolio to maintain your desired asset allocation and risk level. |

| 7. Stay Informed and Educated | Keep up with market trends and economic news to make informed investment decisions and adjust your strategy as needed. |