Sustainable finance is increasingly recognized as a pivotal element in shaping the global economy. As the world grapples with pressing challenges such as climate change, resource depletion, and social inequality, the integration of environmental, social, and governance (ESG) factors into financial decision-making has never been more crucial. This article delves into the role of sustainable finance in fostering economic resilience, promoting responsible investment, and driving innovation towards a more sustainable future.

In the following sections, we will explore how sustainable finance not only supports the transition to a low-carbon economy but also enhances corporate accountability and transparency. Readers will learn about the various financial instruments and strategies that are being employed to align capital flows with sustainable development goals (SDGs). Additionally, we will discuss the growing importance of regulatory frameworks and stakeholder engagement in promoting sustainable practices across industries.

By understanding the multifaceted impact of sustainable finance, you will gain insights into how businesses and investors can contribute to a more equitable and sustainable global economy. Join us as we uncover the transformative potential of sustainable finance and its vital role in shaping a better future for generations to come. Read on to discover how you can be part of this essential movement.

As the world grapples with climate change and social inequality, sustainable finance has emerged as a crucial component of the global economy. This article explores various aspects of sustainable finance, highlighting its significance and impact on economic growth, environmental sustainability, and social responsibility.

Understanding Sustainable Finance

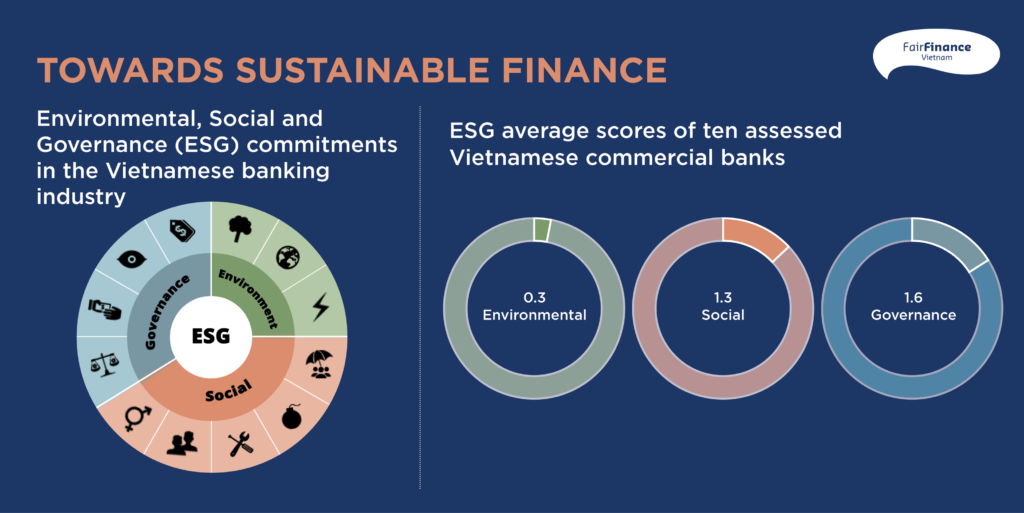

Sustainable finance refers to financial activities that consider environmental, social, and governance (ESG) factors in investment decisions. This approach aims to promote sustainable economic growth while addressing global challenges such as climate change, resource depletion, and social inequality. By integrating ESG criteria into financial analysis, investors can identify opportunities that not only yield financial returns but also contribute positively to society and the environment.

The rise of sustainable finance is driven by increasing awareness among investors and consumers about the importance of sustainability. As a result, financial institutions are adapting their strategies to align with sustainable development goals (SDGs), leading to a shift in capital flows towards more responsible investments.

The Impact of Sustainable Finance on Economic Growth

Sustainable finance plays a vital role in fostering economic growth by directing capital towards sustainable projects and businesses. Investments in renewable energy, sustainable agriculture, and green infrastructure not only create jobs but also stimulate innovation and technological advancements. This shift towards a sustainable economy can enhance resilience against economic shocks and promote long-term stability.

Moreover, sustainable finance can help mitigate risks associated with climate change and resource scarcity. By investing in sustainable practices, businesses can reduce their operational costs and improve their competitiveness in the market. This, in turn, contributes to a more robust and sustainable economic framework that benefits all stakeholders.

The Role of Green Bonds in Sustainable Finance

Green bonds are a key financial instrument in sustainable finance, designed to fund projects that have positive environmental impacts. These bonds have gained popularity among investors seeking to support climate-friendly initiatives while earning returns. The proceeds from green bonds are typically allocated to renewable energy projects, energy efficiency improvements, and sustainable infrastructure developments.

The growth of the green bond market reflects a broader trend towards responsible investing. As more issuers enter the market, the transparency and credibility of green bonds are improving, attracting a diverse range of investors. This trend not only supports environmental sustainability but also enhances the overall resilience of the financial system.

Socially Responsible Investing (SRI) and Its Importance

Socially Responsible Investing (SRI) involves selecting investments based on ethical, social, and environmental criteria. This investment strategy allows individuals and institutions to align their portfolios with their values, promoting positive social change while seeking financial returns. SRI has gained traction in recent years, driven by a growing demand for transparency and accountability in corporate practices.

By prioritizing companies that demonstrate strong ESG performance, SRI can influence corporate behavior and encourage businesses to adopt more sustainable practices. This shift not only benefits investors but also contributes to a more equitable and sustainable global economy.

The Role of Financial Institutions in Promoting Sustainable Finance

Financial institutions play a crucial role in promoting sustainable finance by integrating ESG factors into their lending and investment practices. Banks, asset managers, and insurance companies are increasingly recognizing the importance of sustainability in their operations. By offering green loans, sustainable investment products, and ESG-focused advisory services, these institutions can drive capital towards sustainable projects.

Furthermore, financial institutions can influence corporate behavior by engaging with companies on their sustainability practices. By advocating for transparency and accountability, they can help create a more sustainable business environment that benefits both investors and society at large.

Challenges Facing Sustainable Finance

Despite its potential, sustainable finance faces several challenges that hinder its growth. One major obstacle is the lack of standardized metrics for measuring ESG performance, which can lead to confusion and skepticism among investors. Additionally, the greenwashing phenomenon, where companies exaggerate their sustainability efforts, poses a significant risk to the credibility of sustainable finance.

Addressing these challenges requires collaboration among stakeholders, including governments, financial institutions, and businesses. By establishing clear guidelines and standards for sustainable finance, the industry can enhance transparency and build trust among investors.

The Future of Sustainable Finance

The future of sustainable finance looks promising, with increasing recognition of its importance in addressing global challenges. As more investors prioritize sustainability, financial markets are likely to evolve to accommodate this demand. Innovations in financial products, such as impact investing and sustainability-linked loans, are expected to gain traction, further driving the growth of sustainable finance.

Moreover, regulatory frameworks are evolving to support sustainable finance initiatives. Governments are implementing policies that encourage responsible investing and promote transparency in corporate practices. This supportive environment will be crucial for the continued growth and success of sustainable finance in the global economy.

Conclusion: The Importance of Sustainable Finance in the Global Economy

In conclusion, sustainable finance plays a vital role in shaping a more resilient and equitable global economy. By integrating environmental, social, and governance factors into financial decision-making, investors can drive positive change while achieving financial returns. As the world faces pressing challenges such as climate change and social inequality, the importance of sustainable finance will only continue to grow.

Ultimately, the success of sustainable finance depends on collaboration among all stakeholders, including investors, financial institutions, and governments. By working together, we can create a more sustainable future that benefits both people and the planet.

Sustainable finance refers to financial activities that consider environmental, social, and governance (ESG) factors in investment decisions. It plays a crucial role in promoting sustainable development and addressing global challenges such as climate change, inequality, and resource depletion.

| Aspect | Description |

|---|---|

| Definition | Sustainable finance integrates ESG criteria into financial services, aiming to support projects that have positive environmental and social impacts. |

| Importance | It helps mobilize capital towards sustainable projects, fostering economic growth while ensuring environmental protection and social equity. |

| Investment Trends | There is a growing trend among investors to seek sustainable investment opportunities, leading to an increase in green bonds and ESG funds. |

| Regulatory Framework | Governments and regulatory bodies are implementing policies to encourage sustainable finance, such as tax incentives and reporting requirements for ESG performance. |

| Challenges | Despite its growth, sustainable finance faces challenges including greenwashing, lack of standardization in ESG metrics, and limited access to information. |

| Future Outlook | The future of sustainable finance looks promising, with increasing awareness and commitment from both investors and corporations to integrate sustainability into their financial practices. |

In conclusion, sustainable finance is essential for transitioning to a more sustainable global economy. By aligning financial flows with sustainable development goals, it can help address pressing global issues and create a more resilient economic system.